The landscape of international market entry has fundamentally shifted for Canadian enterprises, with the majority of organizations globally integrating AI into their risk and compliance programs by 2026. Rather than viewing Governance, Risk, and Compliance (GRC) frameworks as regulatory checkboxes, forward-thinking Canadian technology and financial services companies are transforming these systems into strategic market entry tools powered by advanced AI capabilities. This evolution represents a critical shift from reactive compliance to proactive market intelligence, where GRC frameworks serve as the foundation for informed expansion decisions and sustainable growth in volatile markets. Let's unpack how this transformation is taking shape and why it is redefining the path to success in emerging markets.

The strategic evolution of GRC in market expansion

Once seen as a static, box-ticking exercise, GRC has evolved into a dynamic enabler of market expansion, long-term growth, and strategic competitiveness.

According to recent industry analysis, organizations that implement comprehensive GRC frameworks before market entry achieve 40% faster regulatory approval times and experience 60% fewer compliance-related delays during their first year of operations. For Canadian executives navigating complex international landscapes, this strategic approach to GRC provides the operational agility needed to capitalize on emerging opportunities while maintaining robust risk management protocols.

Why emerging markets demand proactive GRC frameworks

Emerging markets present a paradox of opportunity and complexity for Canadian companies, where rapid economic growth coexists with evolving regulatory frameworks and heightened cybersecurity risks. Recent reports from the UAE, a key emerging market, reveal over 223,800 exposed digital assets and a 58% surge in ransomware activity, illustrating the critical need for comprehensive risk management approaches. These statistics underscore why traditional compliance methods fail in dynamic environments where regulations can change overnight and cyber threats evolve faster than defensive capabilities.

The convergence of digital transformation initiatives with complex threat landscapes creates unprecedented demands for integrated AI-GRC frameworks that can adapt in real-time. Canadian companies entering markets like the Middle East, Southeast Asia, or Latin America must navigate diverse regulatory requirements, cultural nuances, and technological infrastructures simultaneously. A proactive GRC framework enables organizations to:

- Anticipate regulatory changes and align promptly

- Identify potential risks before they materialize

- Establish operational resilience from day one

This approach transforms compliance from a cost center into a competitive differentiator.

AI-powered risk intelligence for market entry decisions

Artificial intelligence is revolutionizing how Canadian companies assess and manage risks in target markets, providing predictive insights that were previously impossible to obtain. AI-powered GRC platforms can analyze vast amounts of regulatory data, market trends, and risk indicators to provide real-time intelligence on market conditions and compliance requirements. These systems leverage machine learning algorithms to identify patterns in regulatory enforcement, predict potential compliance challenges, and recommend risk mitigation strategies tailored to specific market conditions.

For instance, AI-driven risk assessment tools can process thousands of regulatory documents across multiple jurisdictions, automatically identifying relevant compliance requirements and flagging potential conflicts with Canadian business practices. This capability enables risk managers to develop comprehensive market entry strategies that account for regulatory complexity while identifying opportunities for competitive advantage. Platforms such as 6clicks equip Canadian organizations with these capabilities through its Hailey AI engine, which maps requirements across multiple frameworks within seconds, pinpoints compliance gaps instantly, extracts risks and issues from assessments automatically, and generates remediation tasks with relevant mitigation strategies, delivering data-driven insights that empower proactive, contextual market entry decisions.

By integrating AI into their GRC frameworks, Canadian companies can reduce market assessment timeframes by up to 75% while improving the accuracy of risk predictions by over 80%.

Building adaptive compliance systems for global operations

The key to successful market entry lies in developing compliance systems that can adapt to local requirements while maintaining global consistency. Adaptive compliance frameworks leverage cloud-native technologies and API-driven architectures to enable rapid deployment and customization across different markets. These systems incorporate automated compliance monitoring, real-time regulatory updates, and intelligent workflow management to ensure continuous compliance without sacrificing operational efficiency.

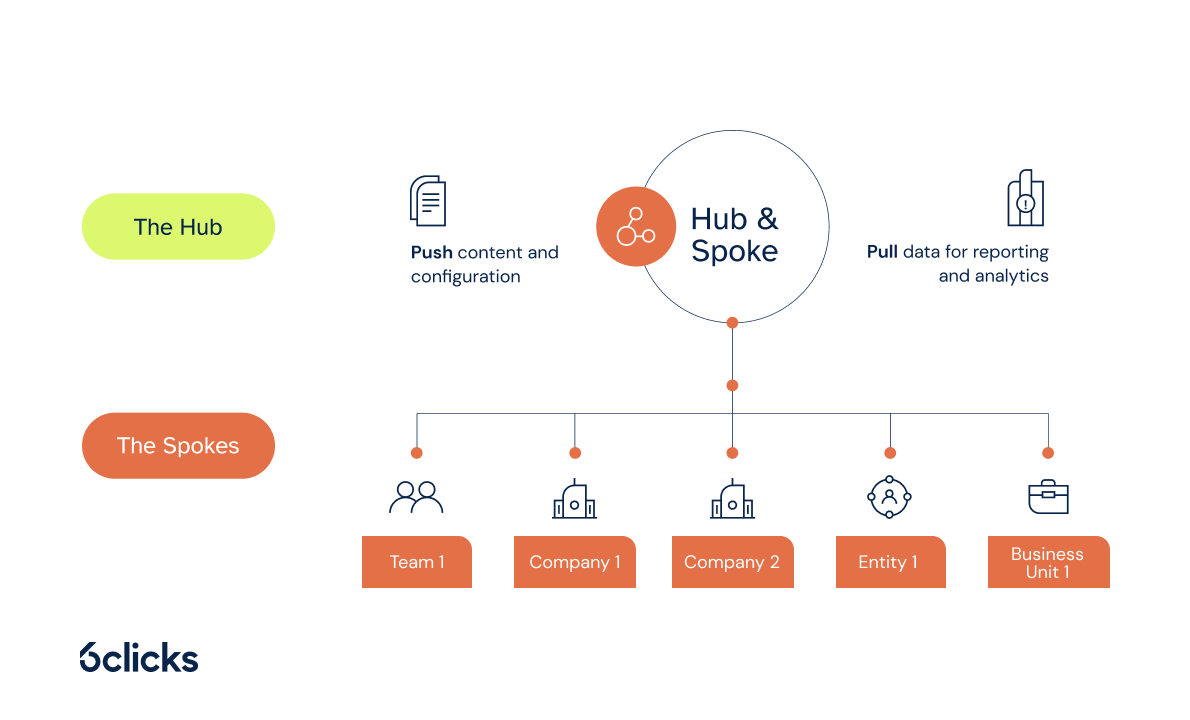

6clicks' Hub & Spoke architecture and deployment model is a strong example of an adaptive compliance system. It enables organizations to centralize oversight and control at the enterprise level while providing autonomy and flexibility for local compliance execution across regions or regulated entities. With the Hub & Spoke, Canadian enterprises can:

- Unify risk, compliance, and audit activities under one platform

- Standardize frameworks, controls, and workflows from a command center called the Hub

- Deploy dedicated environments for each region or entity (called Spokes), all connected to the Hub

- Fast-track implementation with out-of-the-box content, configurations, and integrations

- Maintain ongoing compliance with continuous control monitoring and AI-powered regulatory tracking

Canadian companies implementing adaptive compliance systems report significant improvements in their ability to respond to regulatory changes and manage cross-border operations effectively. For example, organizations expanding into Southeast Asia and Latin America have been able to localize controls in line with regional data protection and financial regulations while still maintaining centralized oversight at headquarters. By bridging local compliance nuances with global governance standards, adaptive systems create a unified approach that reduces duplication, accelerates approvals, and strengthens resilience in volatile regulatory environments.

Measuring GRC ROI in market entry success

Quantifying the return on investment from GRC frameworks requires a comprehensive approach that considers both direct cost savings and strategic value creation. Leading Canadian organizations measure GRC ROI through multiple dimensions, including:

- Reduced compliance costs

- Faster market entry timelines

- Improved risk mitigation outcomes

- Enhanced stakeholder confidence

Studies indicate that companies with mature GRC frameworks experience 35% lower compliance costs and achieve market entry milestones 45% faster than those relying on traditional approaches.

Beyond operational metrics, the strategic value of robust GRC frameworks manifests in improved decision-making capabilities and enhanced market positioning. Canadian financial services firms utilizing AI-powered GRC solutions report improved ability to identify and capitalize on market opportunities while maintaining regulatory compliance. The integration of predictive analytics and continuous monitoring capabilities enables organizations to demonstrate compliance readiness to regulators and partners, facilitating smoother market entry processes and stronger stakeholder relationships in emerging markets.

Conclusion: GRC as the catalyst for global growth

As Canadian enterprises expand into emerging markets, the role of GRC has evolved from a compliance obligation to a core driver of market success. AI-powered intelligence, adaptive compliance frameworks, and continuous monitoring are no longer optional; they are decisive factors that separate organizations that thrive from those that struggle to keep pace.

Enterprises that treat GRC as a strategic enabler can achieve:

-

Faster market entry through streamlined regulatory compliance and reduced delays

-

Lower risk exposure with predictive insights and proactive compliance management

-

Greater resilience across volatile global environments with adaptive, AI-powered frameworks

-

Sustainable growth supported by stronger stakeholder confidence and improved decision-making

By embracing GRC as a foundation for international strategy, Canadian companies can accelerate market entry, maintain compliance with confidence, and build long-term competitive advantage.

Get started with 6clicks

6clicks is purpose-built to help Canadian enterprises simplify global expansion with adaptive, AI-powered GRC. Leverage powerful capabilities designed to streamline your operations and help you secure market entry success:

- All-in-one platform for risk management, compliance, and audit readiness

- Hailey AI for automated risk intelligence and multi-framework compliance

- Hub & Spoke for multi-entity management with centralized global governance

- Content Library for turnkey deployment and regional regulatory alignment

- Continuous control monitoring for ongoing compliance validation